Realtors, triple your business with assumptions.

Accelerate your growth with a powerful set of tools to help you become an assumption master.Start your Journey

Assumptions are the biggest win-win in real estate.

Assumptions are an absolute win-win proposition for buyers and sellers. That means real estate agents have an incredible opportunity in front of them…right now!

Below Market Interest Rate

Buyers are able to assume loans with interest rates as low as 2%! That's a huge win with today's high interest rate environment.

Reduced Closing Costs

Assumable loans can bypass many traditional closing costs, saving a lump sum of money.

No Appraisal Needed

Assumable loans do not require an appraisal! Compared to traditional loans, this saves both time and money.

Save time & succeed with our tools.

We offer a wide array of tools to amplify your business through assumptions.

Get StartedLatest

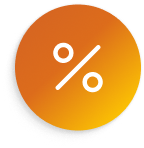

Listings

Instantly view the latest assumableproperties in your area.Updates every 10 minutes

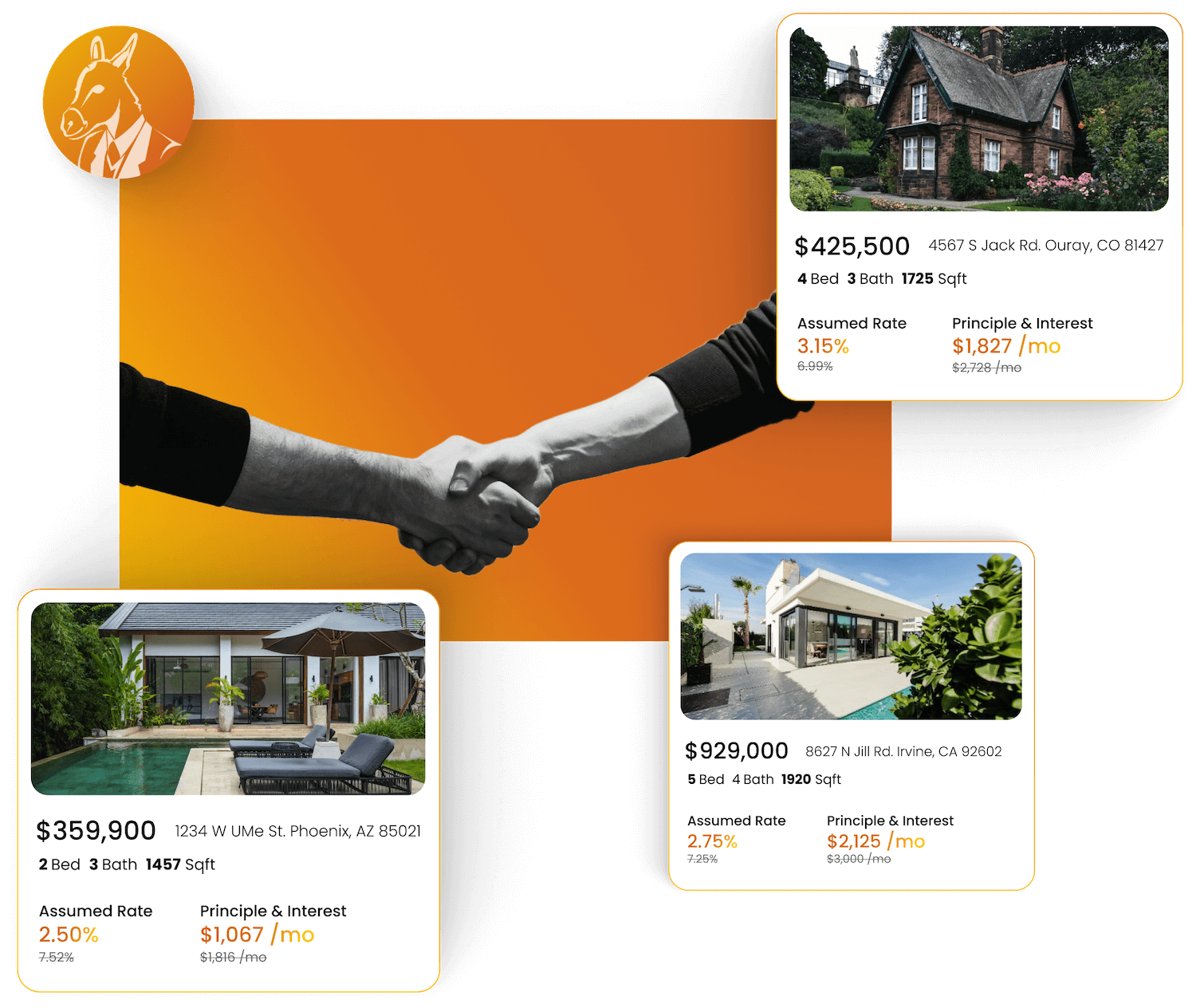

Advanced client tracking

Understand every clients unique behaviors and how they like to communicate.

Powerful client CRM

Save time and manage all of your clients through our robust CRM. Track your clients activity and push them through your pipeline all in one powerful dashboard.

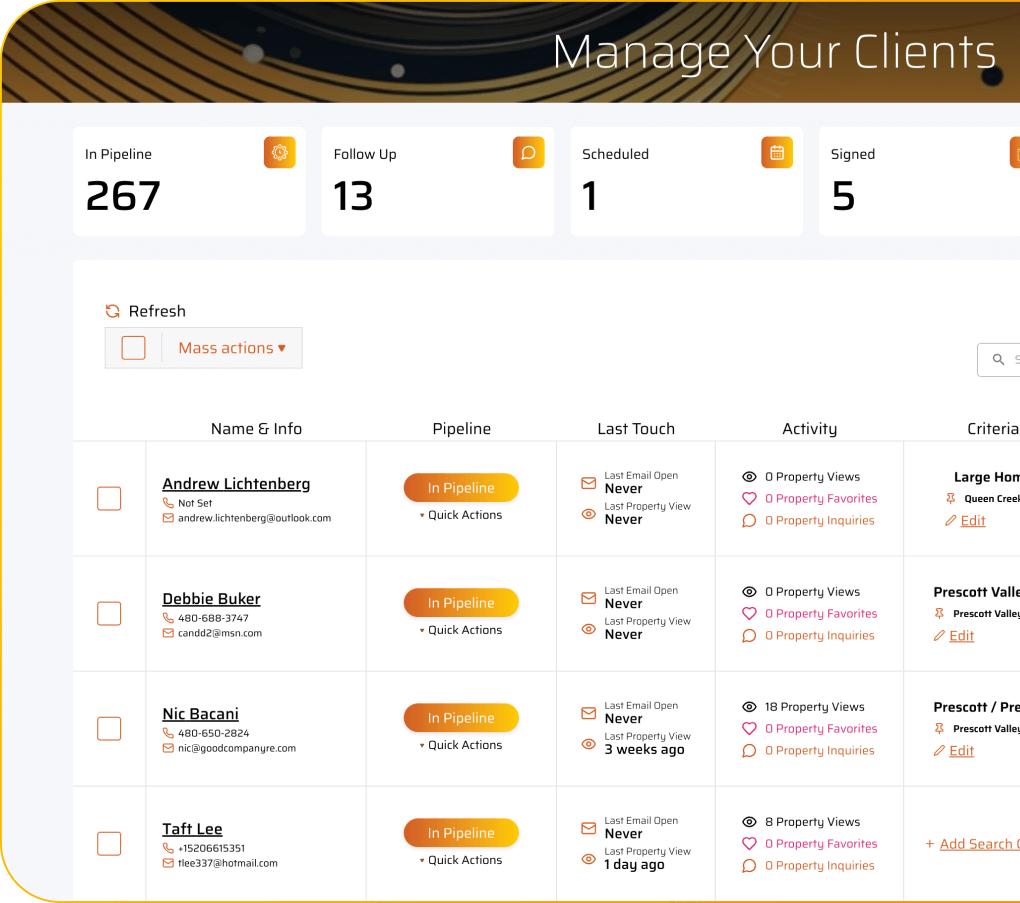

Loan Comparison PDFs

Instantly get a comparison PDF of an assumable loan vs. other traditional financing for any property.

Advanced calculators

Amortization, blended rate, VA entitlement, loan comparison + more.Educating buyers and sellers is key

Real estate agents play a crucial role in educating clients about the benefits of assumable mortgages. We empower you with specialized knowledge and resources to capitalize on this growing trend.

Sell faster & for more

Help potential sellers in understanding all the benefits of assumptions. Address common concerns such as transferability and liability to showcase how assumable loans can streamline the selling process and attract more qualified buyers.Start selling fast

Level up purchasing power

Imagine reconnecting with buyers who previously walked away due to high payments. By educating them about assumable mortgages, you can significantly increase their purchasing power and get them the dream home they always wanted.Start leveling upSpecialized Training & Cerifications

UMe offers essential training, workshops, and customized tools to keep you up-to-date on assumption trends. This empowers you to confidently guide clients through mortgage assumptions and effectively market and close transactions.Sign up today

Meet Mike Roberts, Founder

Our team is revolutionizing real estate with assumable mortgages, and we’d love to help you level up your business. By partnering with UMe, you can attract more buyers and sellers, enhance your credibility as an assumption expert, and have the potential to grow your business exponentially. Watch the video and allow me to introduce myself!

Flexible Pricing

Ready to level up?

If you learn to use our tools effectively, you can overcome any buyer or seller objections. You don’t have to 'sell' anyone on anything. You just have to educate.

Book a 15min intro call

Lean more about how UMe works and how it can help you.Client CRM

Assumable mortgage calculators

Marketing Materials

Enhanced Search Capabilities

Listing Certifications

Latest Listings

And More!

FULL Client CRM

Assumable mortgage calculators

Marketing Materials

Enhanced Search Capabilities

Listing Certifications

Latest Listings

Phone Support

Featured as Specialists (Post Certification)

Lead Generating Landing page

Access to Buyers & Sellers

And More!

FULL Client CRM

Assumable mortgage calculators

Marketing Materials

Enhanced Search Capabilities

Listing Certifications

Latest Listings

Phone Support

Featured as Specialists (Post Certification)

Lead Generating Landing page

Add your Entire Team

And More!

FEEL FREE TO CONTACT US

Do You Have Any Questions?

Check out this FAQ to get more informationCan an investor assume a loan? Which type?

Yes. Investors can assume VA loans. VA does not have a restriction on occupancy in an assumption.

Why are investors clamoring for assumptions?

Investors have been looking for investments that 'pencil out'. With interest rates available in the 2s and 3s, there is no better vehicle than an assumption.

How much down payment do I need?

The down payment needed is the difference between the sales price and the amount owed on the assumable loan. This varies with each home. In some cases, we have seen homes with ZERO down payment needed.

Can I use my current preferred lender to originate the assumption loan?

There is no new originating lender involved in an assumption. We coordinate with the existing lender to transfer the liability.

How is an agent's commission affected by doing an assumable loan transaction?

It is not affected.

With a large delta/gap, what is the minimum down payment for a primary residence buyer?

There is no minimum down payment required by the loan being assumed. The limiting factor is the secondary financing lender. Some offer 5% down payment, but the more economical choice seems to be at 10% down.Contact us for details.

For buyers doing an assumption, are closing costs generally higher, lower or the same?

Generally the overall closing costs are lower. Since there is no new loan being originated, there are no points to pay and no appraisal required*. Title fees are also lower due to the lenders policy already being attached to the current loan. *appraisal may be required if you are using secondary financing.

What is the key difference between a wrap/subject-to/contract-for-deed and a true assumption?

The release of liability. A true assumption releases the seller of all liability.

What are the first steps if a buyer wants to get qualified?

Contact UMe Assumption Specialists to get your buyer PreScreened. PreApprovals for new financing are not applicable in the assumption world. New financing and assumptions have a different set of rules and guidelines. You need to be sure your buyer is qualified for an assumption.

What are the first steps if a seller wants to list their home as assumable?

Contact UMe Assumption Specialists to guide you. Many MLS platforms have specified areas to address whether the loan is assumable or not. We can also certify your property with a copy of the mortgage statement.

How can I check if my loan is assumable?

Contact UMe Assumption Specialists to verify that the home is indeed assumable and under what conditions. Recently servicers have been telling sellers that all loans are assumable. This is technically true, but conventional loans are only assumable under very few specific conditions. In general, if your seller has a government loan, it is assumable.

Follow Us

UMe Assumptions

UMe Realty Group © is committed to and abides by the Fair Housing Act of Equal Opportunity.